A 529 plan is a tax-advantaged investment vehicle designed to encourage saving for the future higher education expenses of a designated beneficiary, typically a child or grandchild. Two types of 529 plans are available, prepaid plans that require direct invoicing from the University and college savings plans.

Step 1: Initiate distribution

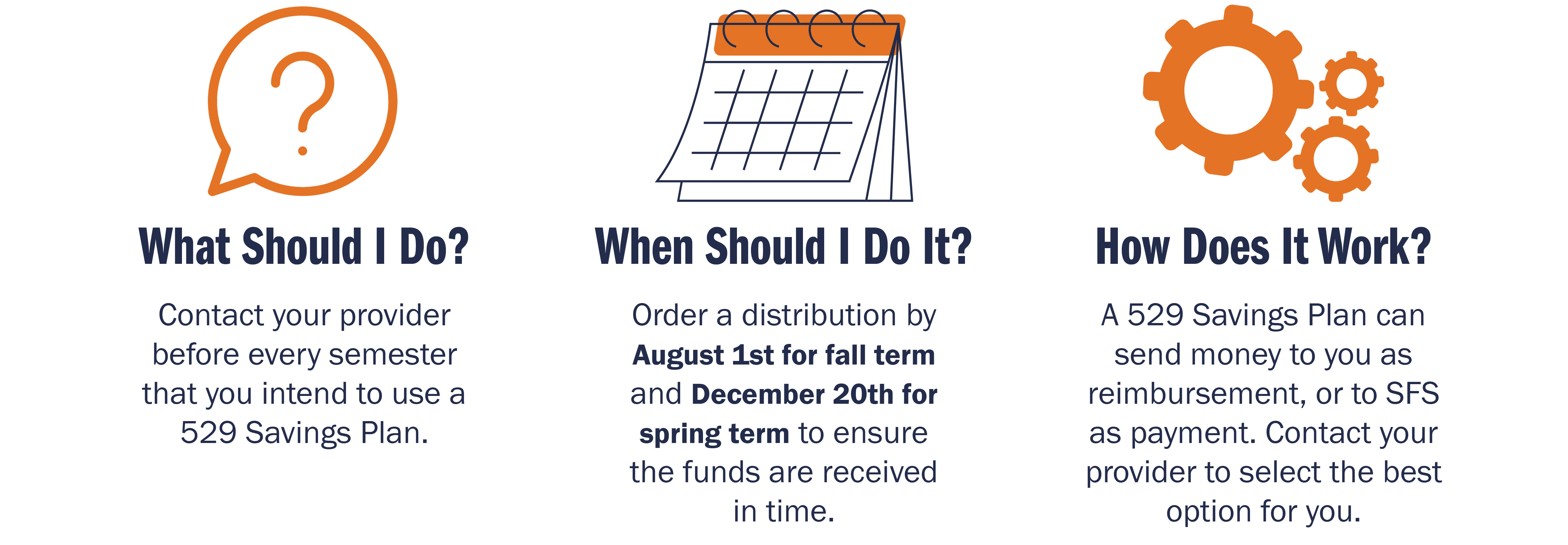

You will need to contact your 529 plan provider each term that you intend to use funds. Payments should be initiated through your 529 plan provider at least two weeks before any payment due date.

Many 529 plans stipulate that fund disbursement must occur in the same calendar year as the corresponding academic term. For the fall term, contact your plan provider to request a distribution no later than August 1. For the spring term, please request a distribution before December 20th.

If funds are not received by the due date, a Student Finance Hold will be placed on the student’s account, regardless of pending funds. If you are concerned about the timing of your payment, please feel free to contact us via phone or email, and we can work together to address any issues.

529 plan funds can cover various expenses such as tuition, fees, books, housing and dining, as well as supplies and equipment required for study at any accredited college, university, or vocational school in the United States and some foreign universities. Off-campus housing costs are eligible for coverage up to the allowance for housing and dining specified by the college for federal financial aid purposes.

Payment Note: 529 Savings Plan payments are treated as personal payments for accounting and 1098-T tax reporting purposes. Whether the payments have a description of “529” or standard personal payment, the designation as a personal payment remains the same.

Tax forms Note: the 1099-Q provided by your 529 Plan Administrator represents different information than the 1098-T form provided by UVA. Depending on timing and other account activity, the values will likely be different.)

Step 2: Options for sending 529 funds:*

-

Where and how to send funds: Depending on your Plan Administrator, you can send the funds to eligible recipients through different distribution types. Please consult your plan provider for distribution options. 529 payments can generally be sent:

-

To the Account Owner or Beneficiary

-

Electronically (or check): Plan administrators can disburse 529 funds directly to the account owner or beneficiary’s personal bank account. Payment can then be made in UVAPay from that bank account via ACH.

-

-

Directly to the college or school

-

Check: You can request the distribution as a check. Please ensure the check includes the student's full name and Student ID number:

-

-

Student Financial Services

P.O. Box 400204

University of Virginia

Charlottesville, VA 22904-4204

-

-

-

Electronically: Some plans have the option to pay electronically via ACH through a distribution network to the school. You will encounter this option during the distribution process if your plan is owned by Ascensus or another partnering plan.

-

Establish an agent as an Authorized User: if your situation allows, you can establish your plan administrator as an authorized user to submit payments on your behalf via UVAPay. Wire transfer options are available with this selection.

-

-

*Please consult your 529 Plan Administrator for all eligibility and distribution related questions. The University of Virigina has no control over transit time or eligibility criteria.

Step 3: Review account

Please monitor your UVAPay account activity to ensure payments process as expected.

Virginia529 and the Prepaid529 Program

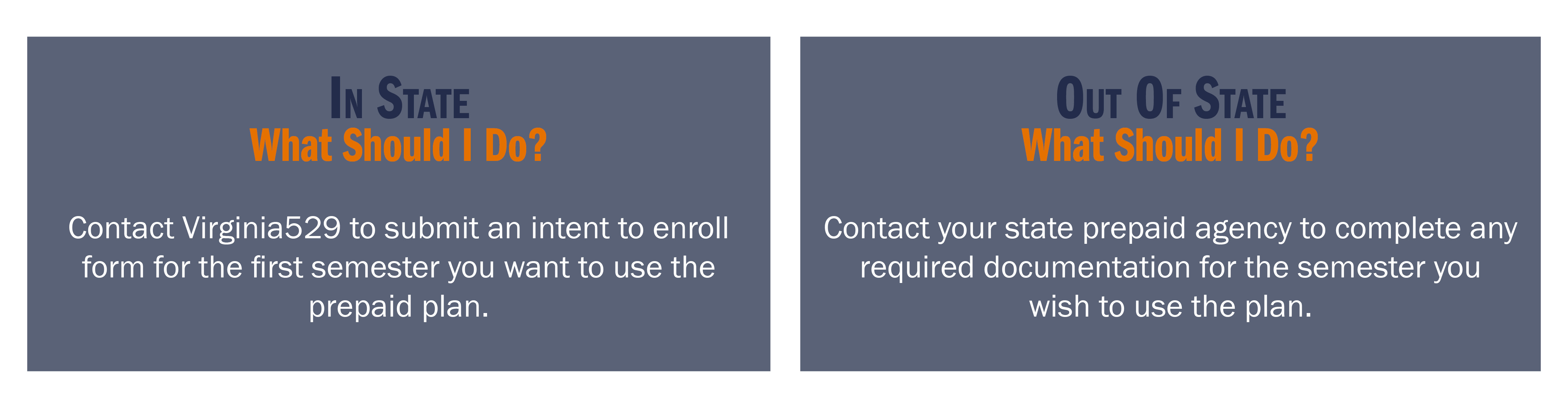

Please log in to your account at Virginia529 to use your Prepaid529 benefits. They may require your student's 7-digit SIS ID, which your student can retrieve through the ITS website. Your student can obtain their 9-digit University ID number at the same website or from the back of their UVA ID card.

Virginia529 will later send a roster to our office with your name, which will indicate to us that we can expect the funds from the prepaid plan. Only then will we place a credit on your account in anticipation for the funds. This process can take 2-3 weeks to complete from the time the intent to enroll form is submitted to Virginia529. There is no need to contact Virginia529 every semester, if you wish to use your Prepaid529 funds ongoing.

After the add/drop period, SFS will invoice Virginia529 for payment. The distribution is typically received 45-60 days after sending the invoice. Once the distribution has been received from Virginia529, SFS will replace the estimated credit and apply the actual payment to the student account.

If your student transfers to a different school or you wish to stop your use of the Prepaid529 benefit, you should then contact Virginia529 directly. Also, SFS does not generally recommend that you use Prepaid529 for either January Term or Summer Session, as in most cases, you will see a reduced value to your benefit for doing so.

A common question we field concerns prepaid plans and differential tuition rates. Please refer to your contract with your prepaid program provider for specifics on what is and is not covered by your contract.

Our mailing address, should you need to provide it to the plan administrator is:

Student Financial Services

P.O. Box 400204

University of Virginia

Charlottesville, VA 22904-4204

Non-Virginia State Prepaid Plans

Please contact your state pre-paid company to ensure you have completed and submitted any required documentation for the semester you wish to use the pre-paid plan. The state pre-paid will then send a roster to our office with your name, which will indicate to us that we can expect the funds from the prepaid plan. Only then will we place a credit on your account in anticipation of the funds.

After the add/drop period, SFS will invoice the state prepaid agency for payment. The distribution is typically received 45-60 days after sending the invoice. One the distribution has been received from the state prepaid agency, SFS will replace the estimated credit and apply the actual payment to the student account.

If you receive a refund due to adjustment of charges and the refund is coming from 529 funds, please contact your fund administrator directly for how to manage that refund. SFS cannot provide guidance on refunds of 529 funds.

Education Abroad & Virginia529 Savings Plans (not Prepaid plans)

Students enrolled in education abroad programs billed directly by UVA may use their 529 savings plan in the same manner as outlined in the above 529 savings section (i.e., contact your plan administrator and request funds to be sent to UVA). For programs that are not billed by UVA, students should contact their 529 plan administrator. Students enrolled in a study abroad program that requires payment directly to the host institution or program provider may request their distribution to be sent directly to the host institution to cover qualifying educational expenses, depending on their plan administrator's guidance. Please consult your situation with your Virginia529 or other 529 plan administrator.

Education Abroad & Virginia529 and Other 529 Prepaid Plans

Students enrolled in education abroad programs that are billed directly through UVA may use their Virginia529 prepaid plans. For programs that are not billed by UVA, students should contact their plan administrator. Students enrolled with a study abroad program that requires payment directly to the host institution or program provider may utilize their prepaid benefits through a benefits conversion process. According to Virginia529, students can convert their Prepaid529 funds into Invest529 funds on a term by term basis. This conversion enables students/account holders to access the cash benefits and pay their desired institution directly for qualified tuition and fees (per their Prepaid529 agreement). Students must speak with their program administrator about the conversion process and eligibility. Please consult your situation with your Virginia529 or other 529 plan administrator.

Admissions tuition deposits are considered nonrefundable early tuition payments. They serve as a down payment and apply towards your first semester tuition and fees. There is no separate line-item charge for the admissions deposit so the University doesn't invoice for the deposit.

Generally, 529 savings funds may be used to pay for admission deposits. However, account holders should contact their 529 administrator to determine if the account is eligible and to process the distribution, as a 529 savings plan payment is not an available payment method through the admissions deposit payment portal. Distributions can usually be made to the account holder or to the institution. We generally advise families to either reimburse themselves or to use 529 funds once all tuition and fee charges post to the student account for their admitted term (for fall, usually by mid-July, for spring, usually by mid-November).

If you would like to use consider using your 529 funds to pay the University directly, please coordinate with your admissions office to ensure the payment is correctly identified and processed as a deposit. All undergraduate admissions deposits should be sent to:

Office of Admission

University of Virginia

P.O. Box 400160

Charlottesville, VA 22904

(Phone: 434-982-3010)

Prepaid 529 plans cannot be used for admission deposits at the time of submitting the deposit payment (the value of the deposit is captured during the first semester's tuition and fee invoicing activity so families will still enjoy the full benefit).

If a student declines enrollment after accepting the offer, the deposit is forfeited. If 529 funds are used for a deposit that is forfeited, the account holder will need to contact their 529 administrator to determine what action may be required by the account holder.

In all things 529 related, please retain all your receipts and documentation and consult with your plan administrator on eligibility and process questions.