Every fall, we conduct an audit of the Student Information System (SIS) for those students who do not have a valid Social Security Number (SSN) or other Individual Taxpayer Identification Number (ITIN) on file. Federal law requires the University to request and for students to provide their SSN or ITIN in order for the University to comply with federal reporting requirements related to the IRS 1098-T form. This form reports payments toward qualifying educational charges to the IRS. For more information about this requirement, please visit http://www.irs.gov and see sections 6109 and 6050S.

Students without an SSN or ITIN in SIS can safely and securely provide it to us through their SIS account in order to comply with this law. If we don't have your SSN or ITIN, you will receive an email notification from SFS in mid-October to guide you through the process.

International Students: Even though you may not have an SSN or an ITIN, you must complete this process to allow the University to meet its obligations to the U.S. Internal Revenue Service. Complete the form and indicate your status as an international student and that you do not possess an SSN/ITIN or intend to file a U.S. income tax return. Then you're done! Thanks for helping us!

In addition to complying with federal requirements, other possible benefits to students include:

1. The Taxpayer Relief Act, which allows students or their parents to claim education tax credits, requires the University to report to the IRS the taxpayer identification number of each student who may be eligible for education tax credits, and any charges for qualified tuition and related expenses placed on the student's account during the previous calendar year. The taxpayer identification number allows us to properly report these charges to the IRS.

2. The National Student Clearinghouse can report to Federal Student Aid that a student is, in fact, an enrolled student, thereby allowing any student loans to remain in deferment while the student is in school.

3. If a student plans to apply for federal financial aid, the SSN is required.

4. If a student is covered on a parent's health or auto insurance, some insurance companies require certification of enrollment.

5. External agencies, such as potential employers, will be able to verify a student's degree on behalf of the University by taking advantage of the National Student Clearinghouse's automated degree verification service.

Steps to update your Substitute W-9S form:

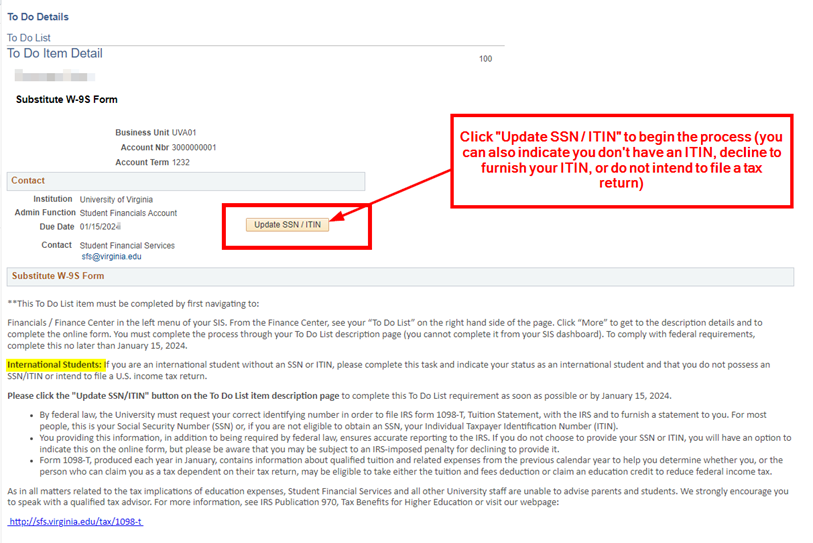

1. Navigate to: Financials / Finance Center in the left menu of your SIS.

2. From the Finance Center, see your “To Do List” on the right-hand side of the page. Click “More” to get to the description details and to complete the online form. You must complete the process through your To Do List description page (you cannot complete it from your SIS dashboard).

3. Click the "Update SSN/ITIN" button on the To Do List item description.

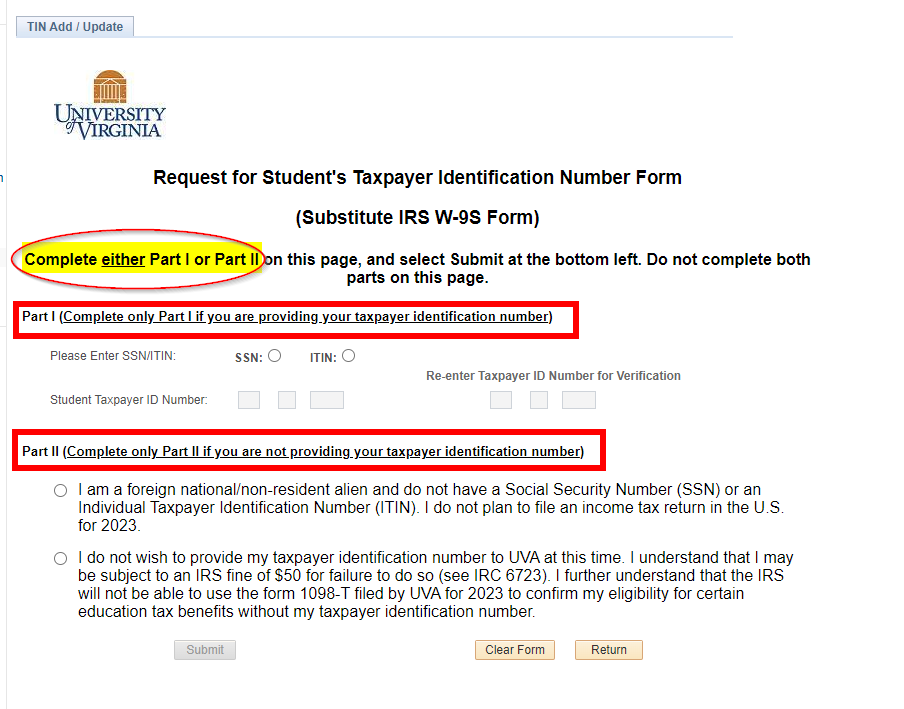

4. Complete either Part I or Part II on the form (you cannot complete both parts).

a. Part I: update your SSN or ITIN accordingly

OR

b. Part II: indicate why you’re not providing your SSN or ITIN. (International Students: If you are an international student without an SSN or ITIN, please complete this task and indicate your status as an international student and that you do not possess an SSN/ITIN or intend to file a U.S. income tax return.)

5. Review information, click “Submit.”

6. You’re all set, thank you!

Image 1: Click “Update SSN/ITIN” after clicking on the To Do List item SIS.

Image 2: Complete either Part I or Part II on the form.