Student Accounts

The University of Virginia, in partnership with Flywire, makes student financial account information available online for viewing and payment through UVAPay.

UVAPay Logins:

- Student UVAPay Login: students access UVAPay from the dashboard of the Student Information System (SIS) account.

- Authorized User UVAPay Login. Not an Authorized User? Here's how to establish authorized access in UVAPay.

UVAPay online portal provides student account access to:

- Charges & Payment Activity: view individual term charges, payments, and overall student account activity.

- Term Statements: to download the Term Statement (Student Account Record) in UVAPay, go to the Account Activity tab, identify the semester (term) box you need, and select “Print Term Statement.” Term statements provide real-time, on-demand account statements that includes line item descriptions and due dates.

- Due Dates: to view individual charges and see the due date, go to the Account Activity tab, identify the semester (term) box you need, and select “See Details” in the lower right of the term box.

- Online Payments & Methods: UVA's preferred method of payment is online through UVAPay.

- eCheck (ACH): We recommend using the FREE eCheck payment method (i.e., the Automated Clearing House [ACH] method requires standard checking or savings routing and account numbers held at a U.S. institution).

- Credit Cards: We also accept all major credit cards (note: a 2.75% service fee applies per transaction).

- International & Wire Transfer Payments: The University partners with Flywire to provide a fast and secure way to submit international and wire transfer payments through UVAPay. You can pay in your local or other desired currency with available payment methods (e.g., international credit cards and debit cards, wire transfers, and other international payment options).

- Semester Payment Plans: The University offers an optional, interest-free semester based Payment Plan. The plan helps families spread the cost of eligible charges over 5, 4, or 3 month payment installments (plan length depends upon time of enrollment). There is a $45 enrollment fee associated with each semester that a payment plan is utilized.

- Reports: In addition to accessing term statements, you can generate account activity reports by selecting multiple terms or choosing a specific date range. This feature provides useful statements for tax purposes or providing to a sponsor to show charges and payments. To access activity reports in UVAPay, go to the Account Activity tab, choose the terms or date range, and select “Generate Activity Report.” The result provides a PDF report of the selected criteria.

- 1098-T Tax Documents: Effective for the 2019 tax year, students and their Authorized Users can access the 1098-T form through UVAPay, if eligible to receive one. Follow this link for more information about Education Tax Benefits and 1098-T forms.

General Billing

The University bills tuition and required fees on a semester (term) basis. Charges for incidental expenses incurred across grounds will also be reflected on your student account and available on your on-demand term statements. UVA makes term statements available online through UVAPay. Term statements include:

- Tuition charges corresponded with your academic program of study.

- Required fees include comprehensive fees, course fees, school fees, and activity fees associated with your program of study. Additionally, University housing (including residential college fees) and dining charges may be required based on your academic year and program requirements (e.g., University housing and dining is required for 1st year students and some athletes. Other students that opt into University housing or dining plan will see their charge on the student account).

- Other/Referred Charges: Incidental purchases across grounds may be charged and referred to the student account. Students are notified of referred charges on a monthly basis. Charges referred to the student account from another University office include the University Bookstore, Student Health, Library, Parking and Transportation, Emergency Ride Program, Honor Loans, and School of Architecture printing fees.

- Credits and Anticipated Credits:

- Payments & Other Credits: any direct payments or outside sponsorship credit will appear on the term statement to reflect the date of receipt. Here’s more information about direct payments and outside agencies including 529 state Pre-Paid Plans and other third-party sponsors.

- Financial Aid & Scholarships: Any financial aid provided by UVA along with outside scholarships and loans you receive will appear as credits on your billing term statement (credits will display as “anticipated aid” until the aid disburses to the account).

Billing & Notification Timeline:

Student Financial Services sends notification emails when electronic bill statements are available for viewing. As new charges occur, monthly account activity email notifications are sent directing you to the UVAPay site where you can view and pay your bill.

In UVAPay, you can authorize others, such as parents and guardians, to also receive billing notifications and have access to your account. Once authorized, parents and others will be directed to the UVAPay link and will be prompted to login with their email and password. Term statements are not sent by mail. It’s essential that all students view their online account and add all responsible parties as authorized users in UVAPay.

Notification Timeline:

- Fall: Fall term bill statement email notifications are generally sent in mid-July and periodically thereafter for new enrollment. The email notifies users their on-demand term statement is available for viewing and to access UVAPay. For security purposes, access to statements requires authentication through UVAPay login. Notifications are sent to students and any established authorized users.

- Spring: Spring term statement email notifications are generally sent beginning in December and periodically thereafter for new enrollment. The email notifies users their on-demand term statement is available for viewing and to access UVAPay. For security purposes, access to statements requires authentication through UVAPay login. Notifications are sent to students and any established authorized users.

- Monthly Account Activity: As new activity occurs and/or unpaid charges become past due resulting in a "finance hold," monthly account activity email notifications are sent directing you to the UVAPay site where you can view and pay your bill. From UVAPay, you can also view the account activity on your student account at any time. Notifications are sent to students and any established authorized users.

- January Term: Varies by enrollment. Please visit UVA’s January Term registration and Payment procedures.

- Study Abroad: Varies by program. Please visit the International Studies Office website for education abroad opportunities and program tuition and costs.

- Summer Sessions: Varies by enrollment. Please visit UVA’s Summer Session registration and payment procedures.

- Due Dates and Notification Schedule: This webpage provides detailed schedules for the fall and spring term statement notifications and general due dates.

Adjustments to Your Account

Adjustments to your account as a result of changes to a financial aid award or housing and dining plans, for example, are available only when the actual charges or credits are applied to your student account. Until the adjustment is applied to your account, the amount owed will be the amount displayed on your statement. External loans or scholarships that are not yet credited to the bill should not be considered when paying your bill.

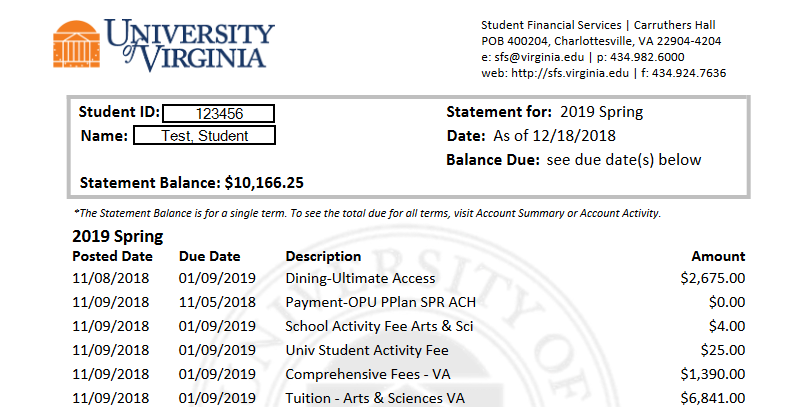

Sample Term Statement

The sample billing statement below presents an example of the detailed credit and charge activity that you will see on your term statements. A detail of current period activity is provided along with a summary of your Previous Balance, New Charges, and Credits.

Payment Responsibilities: What You Should Know

Here are additional things you should know about payment responsibilities and outcomes of late payments:

- Financial Responsibility Agreement: All students must agree to the terms of the University Financial Responsibility Statement. This is completed at a minimum on an annual basis. Students are responsible for satisfying all student account obligations by the due date on the student bill. Students are expected to satisfy all outstanding obligations to the University before they are permitted to attend classes for a given term. If outstanding obligations are not satisfied, courses may be dropped after 5 p.m. on the Friday of the first week of classes.

- Late Payment Fees: The final date for payment of student account balances for University charges is included in the account statement. Bills are available online through UVAPay only. Any student who fails to pay the amount due by the specified payment due date may be subject to a 1.5% late fee assessed on the amount past due. The late fee carries a due date separate from the original charge. Requests for late fee appeals due to extenuating circumstances must be made in writing to [email protected] and must be received by Student Financial Services by the late fee due date.

- Failure to Pay University Financial Obligations: If you have an outstanding debt to the University, students may be subject to one or more of the following:

- Dropped courses and enrollment cancelled for nonpayment.

- Current and former students will have a financial hold placed on their student account preventing them from adding or changing classes.

- Prohibited from reenrolling or being readmitted to the University until the balance is resolved.

- Ineligible for degree conferral or may limit access to an official transcript.

- Returned Check Fee: a $50.00 return check fee will be assessed to your student account for all ACH or paper checks processed as nonsufficient funds (NSF) or bad faith stop payments. The $50.00 fee is in accordance with Virginia State Law (VA Code §8.01-27.1).

- Overpayment & Fraud Prevention: The University will not accept excess direct payments intended for living or other personal expenses. Personal or sponsor payments in excess of $5,000 of the account balance will not be accepted, except as instructed by a sponsor and with prior approval from Student Financial Services. Any such overpayments will be returned to sender or applied to future term charges.

*Failure to meet your financial obligations may impact your enrollment status.*

Financial Aid, Scholarships, & Cost of Attendance

For information about tuition, costs, financial aid, and financial aid related information, see:

Military Educational Benefits, Third-Party and Agency Sponsors, & 529 Plans

For information about processing Military Benefits (Educational benefits, ROTC, Military Tuition Assistance), Third-Party Sponsors (employers and embassies), or 529 Savings & State Prepaid Plans please visit:

- Military Benefits

- Third-Party Sponsors (e.g., employers, embassies, or schools)

- 529 Savings & State Prepaid Plans

When You Graduate

Degree candidates must achieve financial and academic requirements in order to be eligible for graduation related privileges, including receiving their diploma, having their degree conferred, and obtaining their official transcript(s).

Achieving financial requirements refers to fulfilling current financial obligations to the University and completing Exit Counseling for any federal loans (at studentaid.gov) or Nursing or Institutional Loans (at heartland.ecsi.net). SFS notifies degree candidates of any outstanding financial obligations several times well in advance of Final Exercises and/or degree conferral. Students may check their student financial account at any time by logging in to SIS.

For information regarding the specific academic requirements for your program, please see your school advisor or registrar. For general requirements related to graduation and diplomas, please refer to UREG’s policies.

If you cannot bring your account current prior to graduation, contact Student Financial Services to discuss your options.

If You Withdraw from the University

Institutional Tuition and Fees Adjustment Policy

If a student withdraws from the University, tuition and required fees are assessed according to the Institutional Tuition and Fees Adjustment Schedule for their degree program. Here’s more information about the University Tuition and Fee Adjustment Policy.

Tuition Insurance

The University of Virginia has partnered with GradGuardTM to offer tuition insurance from Allianz Global Assistance, which provides reimbursement for non-refundable tuition expenses in the event a covered student needs to leave school before the end of the term for a covered reason.

- Tuition insurance is completely optional. The agreement you enter into is with GradGuard, not with the University of Virginia.

- Enrollment is available on a term-by-term basis.

- *Optional enrollment is required prior to the first day of classes of each term.

Refunds

The University of Virginia complies with all applicable state and federal regulations governing the delivery of refunds on student accounts. Refunds are processed in one of three ways: direct deposit (ACH), paper checks, or credit card returns. UVA strongly encourages students to set up direct deposit details to ensure timely and secure delivery of their refunds.

Please refer to the University refund guidelines established to ensure the ethical, professional, and timely delivery of student account refunds resulting from:

- A direct payment by cash, check, wire transfer, or credit card which exceeds the total charges on the account and does not exceed the overpayment threshold of $5,000 (UVA does not accept direct payments that exceed $5,000 of student account charges);

- A federal financial aid disbursement that exceeds the allowable or authorized charges; or,

- An overpayment of charges by a third party sponsor or scholarship donor.

Tax Forms Related to Student Accounts

The IRS requires UVA to report certain information on IRS Form 1098-T regarding eligible payments received, scholarships received, and grants awarded. This information can be useful in claiming education tax credits on a federal tax return. For more student tax information, see Education Tax Benefits.

Non-U.S. Citizen Information

For foreign tax and other immigration related information, please refer to the UVA Human Resources page on foreign national taxation services.

Still have questions for us? Please contact Student Financial Services at (434) 982-6000 or [email protected].