Check back here throughout the year as your Peer Financial Counselors share their experience and wisdom on a variety of financial topics relevant to college students. Have a suggestion or a request for a blog post? Write to us at [email protected], and let us know what you want to see.

May 3, 2021

As a college student you probably have a bank account. For many of you this bank account is most likely connected to the bank that your parents use and you didn't have a choice when this bank was decided. Now that you are getting close to graduating you might need to decide whether you want to open a new account at a new bank.

To begin this search you should consider a few things:

- How important is it for me to be able to go into a physical bank location?

- How much interest do I want to realistically earn?

- Are there ATMs for this bank near me or do they have partnerships with other banks so I can use the other banks’ ATMs?

- What fees could these banks charge?

Generally there are 3 types of banks:

- Commercial Bank (Bank of America, Wells Fargo, etc.)

- Credit Union

- Online Bank

| Bank | Physical Location? | Interest Earned | ATM Availability | Fees | Minimum Balance |

| Commercial Bank | Yes | 0.01-0.4% | Available in most cities and suburbs | $0-12/month | $0-100 |

| Credit Union | Yes | 0.1% and high dividends | Partnerships, not available everywhere | $0-6/month | $5-25 |

| Online Bank | No | 0.4-0.6% | Some partnerships, not as widespread as credit unions | $0 | $0-100 |

There is no wrong way to go about this decision and many people have accounts in multiple banks, so don't stress too much when doing your research! When you set up bank accounts make sure you have at least one savings account and one checking account.

Good luck!

Alice Opiyo

Peer Financial Counselor, Class of 2022

April 15, 2021

March 9, 2021

Investing can be a powerful tool for growing your money, saving for an important purchase, and funding a comfortable retirement. In this two-part blog post we’ll cover some investing basics and strategies that can help you start managing your own money.

Before You Invest

Before you start investing, there are some important bases you should cover to protect your financial security. First, you should make sure you’re paying all of your bills on time and fully paying off your credit cards each month. Many credit cards have interest rates above 20%, and paying off credit card debt will be financially smarter than investing in most situations. The next things on your checklist should be making sure that you have a balanced budget and are able to cover your basic needs, and creating an emergency fund. An emergency fund is money set aside in case of major disruptions in your life, such as losing your job or having a medical emergency. It serves as a safety net to keep you financially secure and help you get back on your feet if something happens. Most sources suggest putting aside 3-6 months of expenses in an account that can be easily accessed, but this can be more or less depending on your financial situation and outside support networks (perhaps you have parents or family that can help financially in an emergency).

Getting Money to Invest

After you’ve decided you’re ready to invest, the next step is getting money to invest. The most reliable option would be to plan a balanced budget and set a savings goal that you try to meet each month, and investing that money. Another smart strategy is after you finish repaying a debt (such as a credit card balance or student loan), keep those “payments” as part of your budget but instead invest the money. This way you don’t have to make any drastic changes to your spending plan, but are instead investing in your future rather than paying someone else. Finally, putting aside one-time “found” money is a good way to start investing. This can take the form of birthday money, tax refunds, bonuses, and so on.

Figuring Out Your Investment Goals and Strategy

Identifying your goals is one of the most important things to think about and decide on before you start investing. Do you want to save for a car or a down payment on a house? What about an adventurous graduation trip with your friends? Or are you in it for the long haul and want to start saving for retirement? These goals are all very different and require their own investing approach to meet them. Choosing the right strategy for your goals will be dependent on two main things: risk and time. Typically, investments with a potential for higher reward carry a higher risk and fluctuate more in value (known as volatility). Stocks and market-tracking funds are a perfect example: they have potential for higher returns, but you also risk seeing your investments decrease in value more in the short term. This is why time is also such an important factor: the more time you have, the more price swings you can afford to stomach. If you’re investing for the short term—such as saving for a new car in a year, or for a big vacation in 6 months—you would probably want to be in lower-risk investments, like a high-yield savings account or money market account. If you have those savings in the stock market and it has decreased in value when it comes time to spend it, you will either have to cancel your vacation, put it off for a later date, or fund it using money from other sources. On the flip side, if you’re saving for retirement, you might not need to touch that money for over 40 years. This can allow you to stay in higher risk investments with higher potential returns and not stress much about decreases in value today.

Types of Investments

Before we go any further, it’s worth dedicating some time to talk about the common kinds of investments you’re likely to run into. First are stocks and bonds, some of the most broad investment types which you’ve likely heard of before. Stocks are shares of ownership in a corporation, and can also be referred to as equity. Bonds are a loan from an investor to a government or a corporation, and typically pay out interest. Stocks are riskier than bonds, but have potential for a higher return.

Beyond stocks and bonds, other popular investment vehicles are mutual funds and ETFs. Mutual funds and ETFs hold a pool of different stocks, bonds, and other assets that investors can purchase. While there are some key differences between mutual funds and ETFs, they are very similar and can often be used interchangeably in your portfolio. There are a seemingly endless amount of mutual funds and ETFs out there, which can invest in whole different combinations of assets that you might be interested in. However, many of the most popular funds are index funds. Index funds can be either a mutual fund or an ETF and are made to match a market index, such as the S&P 500. Index funds are a passive, low-cost and efficient way to track a particular market index or the stock market as a whole. We’ll come back to index funds later in this post.

Choosing a Brokerage

Now that we’ve covered the basics of investing and investing terms, the next step is choosing a brokerage. There are many popular brokerages out there, and you may have already heard some of their names: Vanguard, Fidelity, Charles Schwab and Robinhood are some of the most popular. There are a wide variety of ways that brokerages will try to differentiate from each other, including offering advanced stock-tracking services, the ability to trade options and derivatives, and professional investor insights. However, as a new investor, there are a few basic features that you should be looking for. You likely want to pick a broker that has low or no trading fees, no annual fee, provides access to buying a variety of low-cost index funds, and allow you to open up individual retirement accounts like a Roth IRA. However, picking a brokerage is a personal decision based on your goals and interests, so make sure to do your research before picking one. If you’re not sure what you need out of a brokerage yet, the ones mentioned earlier are a good place to start looking.

Strategies for Long-Term Investing

Last week we discussed investing goals, and how they are affected by risk and time. Investing money for short-term goals in stocks and mutual funds/ETFs can be risky due to volatility, and you will likely be safer saving money in low-risk accounts and assets. Therefore, we will now discuss safe strategies and methods for long-term investing. Goals for long-term investing could include saving for a down payment on a house in 5-10 years, a future child’s college expenses, or your retirement.

The first safe strategy is choosing to buy and hold your investments, regardless of fluctuations in value. Over the long term, price drops in high-quality assets and indices are usually temporary, and holding on to your investments can prevent you from locking in losses and catching the recovery. The next strategy we want to mention is diversification. By diversifying your portfolio, you can protect yourself from underperformance in one particular investment, sector, or asset class. Lots of research has been done on diversification, and most have found it to be a way to decrease your risk without sacrificing long-term returns; it’s the only “free lunch” in investing. This is where index funds come back in; by buying a quality index fund you are automatically diversified, since your money is spread across hundreds of companies in many different sectors of the economy. It’s a simple and easy way for investors to diversify their portfolio. Next is dollar-cost averaging, a strategy you invest money at regular increments instead of all at once. This can be helpful psychologically; if you put all of your money in at once and it drops 5% over the next few weeks, you might find yourself stressed out and wanting to sell. However, if you’re putting money in every week, you won’t have to stress since you know you’ll be investing more money at a better price; think of it like a discount!

There are two more long term strategies we will mention today. The first is maintaining your asset allocation; another term for sticking with your strategy. Say you decide to invest for a house down payment in 5 years, and want to put your 60% of your savings in stocks and 40% of your savings in bonds. If stocks perform great over the next year, you might find yourself accidentally with 65% of your savings in stocks and 35% in bonds. By maintaining your asset allocation, you can safely stick with the strategy you decided on at the beginning of your journey and help avoid some unpleasant surprises. The last tip we have is reinvesting dividends. Many stocks pay dividends each quarter, and it might be tempting to transfer them to your bank account for some extra spending money. However, most brokerages offer a dividend reinvestment (DRIP) plan, which will add the dividends to your existing investment and can greatly increase your returns over the long term due to compounding.

If you’re interested in investing, we hope this blog post provided some useful background about what to consider before you start.

Jack Ray

Peer Financial Counselor, Class of 2021

March 1, 2021

Did you know it’s roughly 325% more expensive to eat a meal at a restaurant instead of cooking at home? This is why it’s very important to come up with a solid budget for food. Below I’ll share some tips on how to go about getting the most bang for your buck when going to the supermarket!

Buy Store Brand Products

Ask yourself how important it is to buy a specific brand of a certain product. Do you really consciously want to spend more money on say trash bags, q-tips, flour, or sugar? Or would you be okay buying the generic store brand? Of course, you don’t have to do this with everything on your list, if you really like, say a particular brand of cookies, by all means, go for it! However, there’s always something on your list you could replace for the store brand.

Buy a Large Value Size

Instead of purchasing individually wrapped products, buy the value size option when possible and portion it yourself. Value sizes are almost always a better deal than snack sizes. It might not be as hard as you think to portion food yourself. This will also produce less waste than pre-packaged items, so it’s a double whammy!

Avoid Pre-Washed, Pre-Portioned & Pre-Sliced Products

You pay a premium for pre-washed, pre-portioned and pre-sliced products, when there is likely no reason for this. You can easily rinse your own lettuce and shred your own cheese, right?

Choose Multi-Purpose Products

Certain products (especially cleaning products) are advertised as having different uses but in reality consist of the same ingredients. Buying a multi-purpose cleaner, for example, could be all you really need to clean your household.

Use Coupons and Rewards

Spend time going through the store flyer for coupons – it doesn’t take as long as you’d think. Some supermarkets even have coupons available on their website, so you could do this before even getting to the supermarket. Plan on getting a rewards card if you don’t already have one. These are free and always come with some type of perk!

Unit Pricing

Most supermarket price labels have something called “unit pricing,” which is the price per unit (say price per pound, or price per ounce) you pay. These aren’t super obvious at first and are usually displayed in a smaller font than the actual price of the product, but it’s definitely a number to watch out for. It’s easy to be misguided by the price of the product, without really looking at how much of the product you’re buying. You might think all packages are selling the same amount, of say quinoa, but they usually don’t weigh the same amount. This might lead you to choose the one that looks cheapest, when in reality you are paying more per pound than you would if you were buying another brand.

Simple Steps to Stop Eating Your Money:

- Go out to dinner less often

- Take your lunch to work or school

- Make smarter decision when eating out

- Buy frozen fruits and vegetables

- Buy store brand items

- Eat your leftovers

These tips could save you up to $5,000 per year. 😊 Hopefully you found this helpful, best of luck on your financial wellness journey!

Issabella Colón

Peer Financial Counselor, Class of 2021

February 9, 2021

With tax season quickly approaching, you may have questions about when and how to file your taxes, or whether you even have to file in the first place. Here are the basics you should know about filing:

Do you need to file taxes?

If you are unsure whether you need to file a tax return, complete this short questionnaire on the IRS website which will help you determine if you are required to file a federal tax return or if you should file to receive a refund. (Even if you aren’t required to file, you may be able to receive a refund of the taxes that were withheld from your paychecks!)

When should you file taxes?

This year, the IRS will begin accepting and processing 2020 tax returns on Friday, February 12. You can file your federal tax return as soon as you have all the necessary information and documents. The deadline to file taxes each year is April 15, so make sure to do it before then!

What do you need to file taxes?

If you are employed:

- Personal information: name, address, Social Security number

- W-2 Forms

If you are self-employed:

- Personal information: name, address, Social Security number

- Forms 1099-MISC, 1065: Schedule K-1

- Records of all work-related expenses (check registers, credit card statements, receipts)

- Business-use asset information (cost, date placed in service, etc.)

- Office in home information (if applicable)

- Record of estimated tax payments made (Form 1040-ES)

Other documents, such as Forms 1099-INT, 1099-OID, 1099-DIV, and other 1099s, will be needed if you have received them. For more details on all of the information you may need to file your taxes, take a look at this helpful tax preparation checklist for students.

How do you file taxes?

You can file for free using Free File through the IRS, TurboTax, or H&R Block!

If you are seeking tax advice/filing assistance or have in-depth questions, we encourage you to consult a tax professional or contact the CASH Program through Madison House at UVA.

Fiona Chow

Peer Financial Counselor, Class of 2022

November 20, 2020

Are you looking to get a credit card? Excited to just swipe your card and not have to pay cash? Well, before you go on a shopping spree, here are some things to consider!

When selecting a new credit card:

- Read the terms! Many credit cards offer great deals at the beginning of your contract, so read the fine print and make sure you understand what the interest rate is after the beginning deal expires.

- APR: This is the annual interest rate for borrowing money.

- Is the APR fixed or variable? Variable APR’s can change over time, while fixed will be the same the entire time you have the credit card.

- Rewards programs: Some cards will offer rewards on travel, shopping, give cash back, etc.

- Is there an annual fee? So much for the rewards if you wash out those benefits with a fee!

- To start exploring your options, NerdWallet is a great resource: https://www.nerdwallet.com/the-best-credit-cards?trk_copy=hpbestcc

You might be feeling overwhelmed after reading all of the considerations, but there is no need to be. Here are a few tips to best manage your credit card:

- Only charge what you can pay. If there is one thing you remember, remember this! Charging more money to your card than you have is where things can go downhill, and fees pile up quickly. It might be tempting, but THINK before you swipe!

- Pay the balance each month in full. This is how you avoid the interest expenses talked about above.

- Read your statement each month, and make sure the charges are actually yours.

- If you think you may forget to pay your bill, sign up for e-bills and automatic payments. Or set monthly reminders on your phone so you don’t slip up.

Check out the blog in the future to learn more about using your credit card to build your credit score and credit history, so you can be ready to make bigger purchases in the future!

Lauren Wells

Peer Financial Counselor, Class of 2022

November 13, 2020

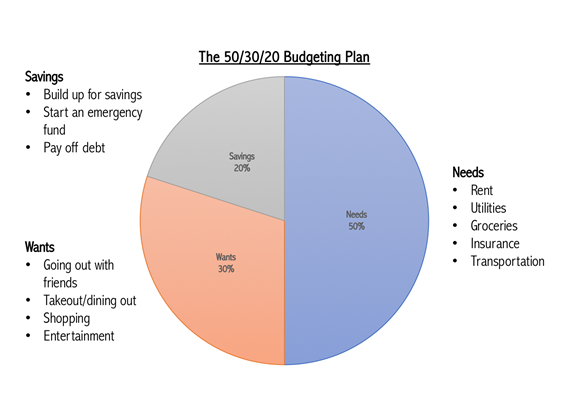

An essential step in having a better relationship with your finances is understanding the importance of having a budget. When most students think of budgeting they think of it as a restrictive spending plan that doesn’t allow them to go out with friends or make fun purchases. However, a budget built specifically for you will not restrict your spending or prevent you from having fun! One of the most popular budgeting plans is the 50/30/20 budgeting rule, where 50% of your income goes towards your needs, 30% towards wants, and 20% towards savings and paying off debt. The 50/30/20 rule can be adjusted for your specific needs, such as increasing your wants or decreasing savings (however it’s never too early to start saving!).

Below is a chart depicting the different categories and the type of spending that is attributed with each one. Needs and wants may differ by circumstance and person, but generally are as shown below.

Steps in building a successful budget:

- Identify all sources of income. This can be from a part-time job, left over scholarship funds, or savings from a summer internship/job.

- Calculate your expenses for a typical month or week, depending on how often your spending fluctuates per week. This Interactive Spending Worksheet is a great tool to use to quickly identify and add up all your expenses and check if you’re overspending.

- Once you calculate your expenses, be honest with yourself and identify your spending habits and see where you could cut down on spending. This is sometimes difficult and it takes time to fully adjust your budget to where you want it to be.

- Categorize your spending into needs, wants, and savings. Sometimes it’s necessary to cut down on wants to be able to cover your needs or maybe you would like to start saving or start paying off some your student loan debt.

- Once you’ve categorized your spending and come up with some new rules for yourself, (only eating out twice a week or cutting out unnecessary subscriptions) it’s time to put that new budget to work!

- Try out your budget for a least two weeks and see how well you’ve stuck to it! If it isn’t working out for you, re-evaluate your budget and see what changes need to be made to make it work.

Tips

- You can use excel to keep track of your spending or use budgeting apps such as Mint or PocketGuard.

- You’re more likely to stick to your budget if you start by making small changes to your spending habits and if you create your budget with a goal in mind.

- It’s okay if you deviate from your budget at first as it may take time to adjust your spending habits!

Deirdre Flood

Peer Financial Counselor, Class of 2021