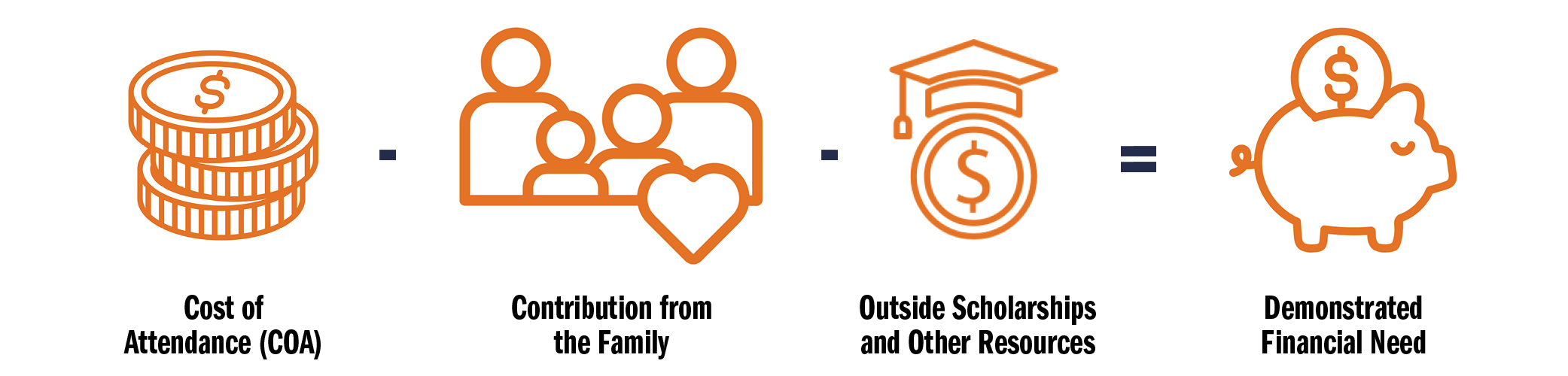

The primary responsibility for financing an undergraduate college education rests with students and their parents. For graduate students, the responsibility rests with students and, if applicable, their spouses. Eligibility for financial aid is based on the following formula:

The Cost of Attendance (COA), which is determined each year by the University's Board of Visitors and Student Financial Services, represents the estimated total cost of attending the University for one year. COA includes direct charges, such as tuition, housing, dining, and fees, as well as indirect costs like books and supplies, living expenses, and travel money.

The contribution from the family is calculated using federal guidelines and University policies and is based on information submitted on the Free Application for Federal Student Aid (FAFSA) and additional documents submitted to UVA. The contribution from the family has a parent and a student component. The parents' and student's contributions are based on their income and assets, which include cash, checking, savings, and money market accounts; their investments and real estate holdings other than their primary residence; their untaxed income; and their business and/or farm equity.

The financial aid offer that students receive from UVA lists the types and amounts of grants, work-study, loans, and scholarships awarded. UVA will meet 100% of students' demonstrated need through a combination of grants (from federal, state, and institutional sources), federal need-based loans, and federal work-study. A list of items that may impact a financial aid offer can be found in the 'Items That May Impact/Reduce Your Award' section below..

Two important things to note:

- The total amount of financial aid students receive, including outside resources such as scholarships, cannot exceed their cost of attending the University.

- It is possible for students' contribution from the family to be greater than their cost of attending the University; in this case, they do not demonstrate eligibility for need-based financial aid. However, financial aid programs such as the unsubsidized Federal Direct Loan, the Direct (Parent) PLUS Loan, and alternative loans, are available to students regardless of their financial need.

Please be aware that it is UVA’s philosophy that, to the extent they are able, both biological parents share a responsibility to help pay for the education of their dependent children. A parent’s unwillingness to contribute is not necessarily grounds for a waiver of the Profile application. In cases where a divorced parent of record (for FAFSA purposes) has remarried, stepparent information is also required.

The federal financial aid program defines some applicants as self-supporting independent students. Students are considered independent for federal aid purposes when they meet one or more of the following definitions:

- they are 24 years of age or older

- they are graduate or professional students

- they are a veteran of the U.S. Armed Forces

- they are an orphan, foster child or a ward of the court

- they are legally married

- they are currently serving on active duty for purposes other than training

- they are emancipated or under a legal guardianship

- they have legal dependents other than a spouse for whom they provide more than half the support

- they have a child for whom they provide more than half the support

- they are a homeless unaccompanied youth

Undergraduate students cannot declare themselves independent of their parents due to family disagreement, living arrangements, or parents' unwillingness to contribute to the costs of their education. Find more information about completing the FAFSA as an independent student.

In most cases, independent students for whom the costs of attending the University are high are offered additional federal loan awards.

Student Financial Services wants to be responsive to unique family situations, within the limits of federal regulations and University policies. We will consider an Appeal for Reconsideration when:

- A family experiences a change in their financial situation, such as death of a parent or unemployment; or

- A family has an extenuating circumstance or hardship that was not addressed in the initial review.

If you have circumstances you believe should be evaluated, please review our Appeals for Reconsideration page to determine if you are eligible to file an appeal.

Income

- IRA or pension distributions (excluding rollovers during the base tax year)

- Capital gains

- Business draws not included as taxable income

- Support from family members (untaxed income)

- Parent’s remarriage

- S-Corp, Corp and/or partnership distributions

Family

- Students attending graduate or professional school

- Students not attending eligible title IV school

- A sibling turning 24, even if that sibling still receives parental support

Assets and Investments

- Acquisition of assets or investments

- Moving out of primary residence but still owning the home

- Parent’s remarriage