2024-2025 Academic Year

Getting Started

Haga clic en este enlace para ver esta página en español

1) Am I Eligible for Financial Aid?

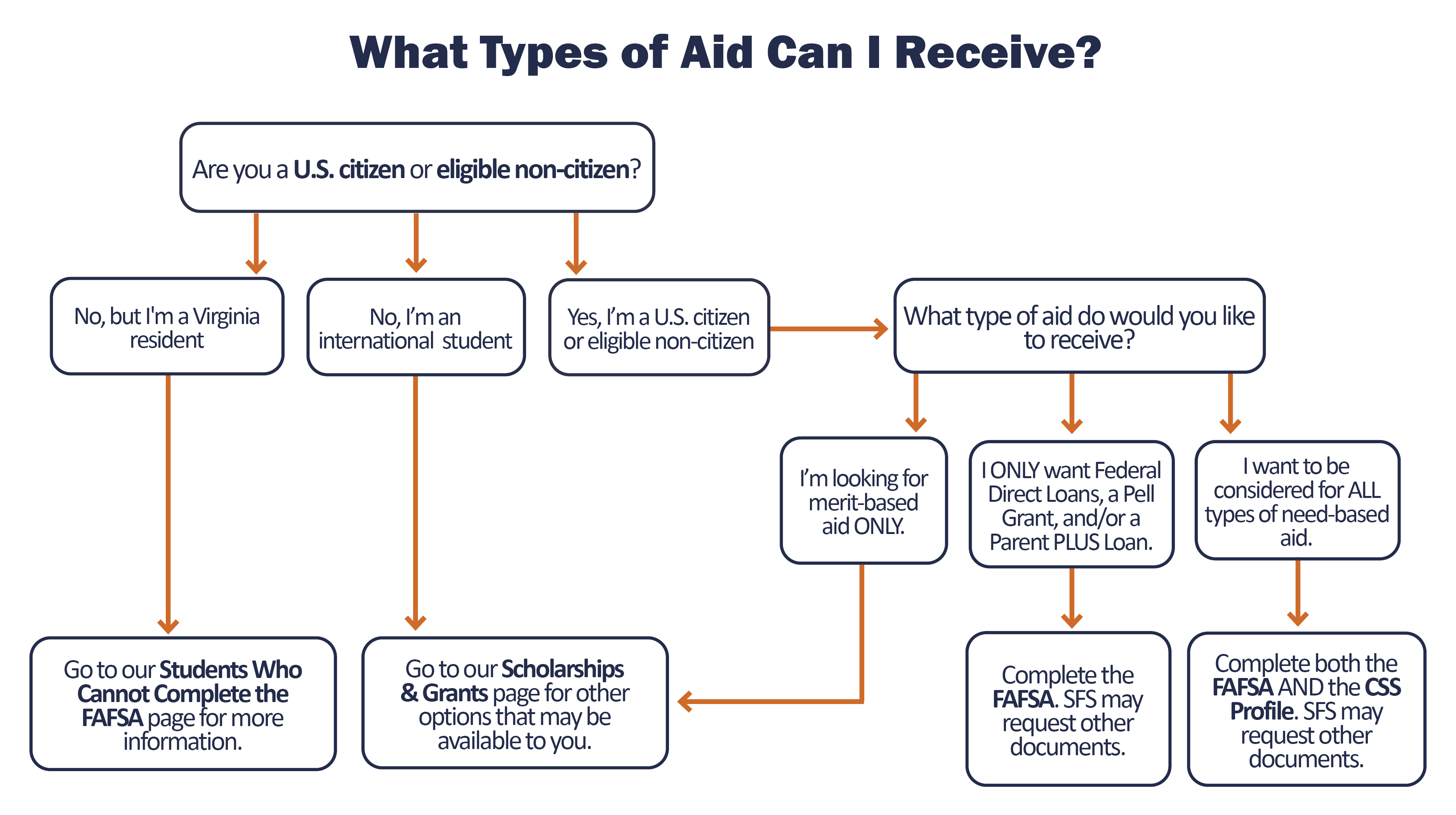

- If you are a U.S. citizen or an eligible non-citizen, complete the CSS Profile (available now) and the FAFSA (available in December). We recommend completing the Profile only if you believe you will qualify for and/or want to be considered for all forms of need-based financial aid.

- If you are not eligible to complete the FAFSA and live in Virginia, you may be eligible to complete the VASA application. Please review the application page to learn more.

- If you are an international student, please see our Scholarships & Grants page.

2) When Should I Apply for Financial Aid?

To be considered for all forms of need-based financial aid, including state and University grants and scholarships, complete the FAFSA and the CSS Profile as soon as you are able to do so.

We understand that, with changes to the FAFSA, some of you may not yet be able to complete the FAFSA at this time. We'll still meet 100% of your demonstrated financial need whenever you are able to complete it, and we want to get your financial aid offer to you as soon as we can. If you ever have questions, we hope you'll reach to us for help.

3) How Do I Apply for Financial Aid?

If you believe you have financial need and want to be considered for all forms of need-based financial aid, complete and submit:

- the 2024-2025 CSS Profile

- the 2024-2025 FAFSA

Our CSS Profile school code is 5820, and our Federal School Code for the FAFSA is 003745. Click here for common application errors and how to avoid them.

If you are not eligible to complete the FAFSA, you may still be eligible to complete the VASA application.

Please review the VASA application page and our resources for Students Who Cannot Complete the FAFSA to learn more. Students who cannot complete the FAFSA include students with DACA status or with a different undocumented status. Note that the VASA application will likely not be released until several weeks after the FAFSA.

If you are interested only in federal financial aid, complete and submit only the 2024-2025 FAFSA.

The U.S. Department of Education has prepared a checklist of documents and information to have available when you’re completing the Free Application for Federal Student Aid (FAFSA).

If you are interested only in merit-based aid, please see our Scholarships & Grants page for non need-based options that may be available to you.

4) What Do I Do Next?

Completed all the applications you need to? Good job! Now, we'll review your information for financial aid eligibility. Meanwhile, check your To Do List in the Student Information System (SIS) to see if we are asking for additional items, such as parent and student tax documents. If there are items still on your list, that means that you really have "to do" them!

Some applicants might get a document request by email from IDOC at the College Board.

Some students are chosen for a required process called verification. If you've been selected, we'll send you an email to let you know. And again, you'll want to keep an eye on your To Do List in you SIS.

If your parents are divorced, separated, or were never married, see this page for more information.

A note about scholarships: UVA meets 100% of a student's need with scholarships, grants, work-study and need-based loans. Generous donors provide much of the scholarship and grant funding. Your financial aid application submission authorizes the University to show your name, demographic information and relevant offer amount(s) to University Advancement and applicable donors(s). If you receive a donor-funded grant or scholarship, you can ‘opt out’ of this disclosure as required by the Family Educational Rights and Privacy Act of 1974 (FERPA) at that time.